CLANCY looks at tax strategies for farms and small businesses in an article written in two parts. This month he tackles income tax and next month he will focus on capital gains tax.

SMALL businesses are the engine room of our economy, representing 99 per cent of all businesses in Australia. There are a range of benefits available to small businesses that are aimed to assist in growth and to provide tax-related relief.

Although 99 per cent of businesses are considered small businesses, there are differing qualifications for income tax versus capital gains tax purposes. That is, you may be considered a small business for income tax purposes however may fail the criteria to be considered a small business for capital gains purposes.

The implications of which could be significant and are important to consider before undertaking any form of transaction including succession planning and restructuring.

Given the variances between income tax and capital gains qualifications, and the benefits they each provide, it wouldn’t be comprehensive to discuss either at a mere glance. So instead the focus will be on income tax for this discussion and capital gains next month.

Before examining what concessions are available for income tax purposes, consideration must be given to whether the trading entity qualifies as a small business.

To be considered a small business for income tax purposes the entity, its connected entities and affiliates must have an aggregate turnover of $10m or less.

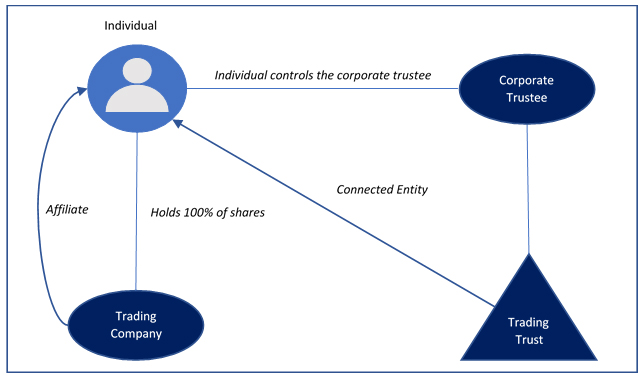

A connected entity is either an entity controlled by you, an entity controlled by the same third party that controls you, or an entity controlled by an entity you control.

For example a partnership and a trust may be considered connected entities if they are controlled by the same individual, resulting in the aggregate turnover of both to be considered to pass the turnover test.

An individual or company is considered your affiliate if they are considered to act in accordance with your directions or wishes, or in concert with you. If the aggregate turnover of you, your connected entities and affiliates is less than $10m, you are eligible to apply small business tax concessions.

Taking the above diagram for example when calculating the aggregate turnover of the group, the individual, company and trust turnovers must be considered in calculation of the $10m. That is because the company is an affiliate of the individual because they own a controlling share, and the trading trust is a connected entity because it is controlled by a corporate trustee controlled by the individual.

It must also be noted that the turnover of the group can be calculated on current or previous financial results, or an estimation can be done on the current year turnover by doing a forecast. This is noted as a consideration however given the complexity it won’t be discussed in further detail.

The diagram exemplifies the challenges in calculating the aggregate turnover and specific considerations should be given to each family group as to what entities and individuals should be consolidated for the turnover test.

Though the list of concessions for small businesses are quite extensive, the most used and the focus for this discussion, will be the simplified depreciation rules and allowable deductions.

The first and most commonly used is the instant asset write-off, which enables any assets purchased below a certain threshold (exclusive of GST) to be immediately deductible.

Legislation has recently been passed to increase this threshold from $20,000 to $30,000 and the turnover threshold to be eligible for this concession to be increased from $10m to $50m depending on the date the asset was purchased and installed ready for use.

The table shows the dates and changes in thresholds for the instant asset write-off.

| Date Range | Income Threshold | Threshold for each asset (GST exclusive) |

| 12/05/2015 to 28/01/2019 | $10M | $20,000 |

| 29/01/2019 to 02/04/2019 | $10M | $25,000 |

| 02/04/2019 to 30/06/2020 | $50M | $30,000 |

For depreciable assets that do not qualify for the above, a simplified depreciation system is offered to small businesses to assist in the calculation of depreciation and in some circumstances increases the deductible amount of assets in the current year.

These depreciable assets will be added to the small business asset pool which allows a 15 per cent deduction in the first year regardless of when it was purchased, and a 30 per cent deduction each year thereafter on a diminishing basis.

In addition to the depreciation rules, small businesses can also access allowable deduction concessions not available to other businesses. The most prominent of these is the allowance of prepaid expenses. Under this rule prepaid expenditure is immediately deductible if these criteria are met:

- the eligible service period for the expenditure is 12 months or less; and

- the period ends no later than the last day of the income year following the year in which the expenditure was incurred.

Applying these criteria in a practical sense, it’s easy to see how they allow, or limit, certain expenditure.

For the first criteria to be met, the prepaid expenditure cannot be greater than 12 months, so for example an allowable deduction for insurance would be prepaying the cover for the next 12 months, a deduction is denied if the insurance is for a period greater than that, so a 14-month policy would not be allowed.

The second rule states the last date cannot exceed the last day of the following income year.

Taking the insurance policy as an example again, if on 15 June 2018 an amount of $10,000 was prepaid for an insurance policy providing cover from July 18 and ending in July 19, the total amount deductible in the year ended 30 June 2018 would be NIL, even though this is when the expenditure occurred. This is because the policy would run out past the last day of the next financial year which in this case would be 30 June 2019.

If the same insurance policy of $10,000 was incurred on 15 June 2018 and cover started immediately for the next 12 months then the full $10,000 would be deductible.

Applying the 12 month rule can be a useful tax-planning strategy if there is excess disposable cash towards the end of the financial year.

For example if there was a loan incurring interest it may be beneficial to prepay the next 12 months of interest prior to 30 June, this is because it is expenditure that would be incurred regardless and would decrease assessable income in the current financial year as an immediate deduction.

Additional immediate deductions that are specific to primary production businesses (regardless of meeting the small business tests) are:

- fodder storage assets;

- fencing; and

- water facilities.

Please note that the fodder storage asset deduction underwent legislative change in August 2018. Prior to 19 August 2018 a fodder storage asset was depreciated over three years.

Fencing and water facilities became immediately deductible on 15 May 2015. The definition of a fodder storage asset is defined as having a primary purpose of storing fodder and is used in a primary production business.

So, 19 August 2018 is an important date as it means in the current financial year there will be differing amounts that are deductible for the same asset depending on when it was purchased (or ready for use).

If it was prior to 19 August, then it is only partly deductible (one-third will be deductible in the current year), if after this date then the full amount is deductible.

About the Author:

Clancy Cox is a fourth-generation cattle farmer from the Cox and Atkinson lineages. His great-grandfather Monty Atkinson was instrumental in developing the droughtmaster herd which is still incorporated in the family operation today. Clancy was born and raised on “Glensfield Station,” a cattle station 45km west of Mackay. The family operation runs 10,000 head of cattle for breeding and fattening across three properties.

Clancy has a unique understanding of the agribusiness sector, combining his involvement in the family operation with skills he has developed as a Senior Accountant at PVW Partners.

Clancy is passionate about growing regional Australia.

Disclaimer

Information provided in the article is of a general nature and is intended for informative purposes only. It does not take into account personal financial circumstances. Tailored professional advice should be sought before acting on any of the information contained above.